MicroStrategy’s Michael Saylor has unveiled a new Bitcoin reserve plan worth $81 trillion. The plan targets changes in the cryptocurrency market. It aims to push Bitcoin adoption forward while dealing with regulatory uncertainty. Saylor wants to make the US the leader in digital assets.

Also Read: Experts Predict 3,000% Surge for These Altcoins—XRP Not Included

Exploring Saylor’s $81T Bitcoin Reserve: How It Could Address Crypto Risks and Revolutionize Financial Stability

Strategic Vision for Digital Asset Policy

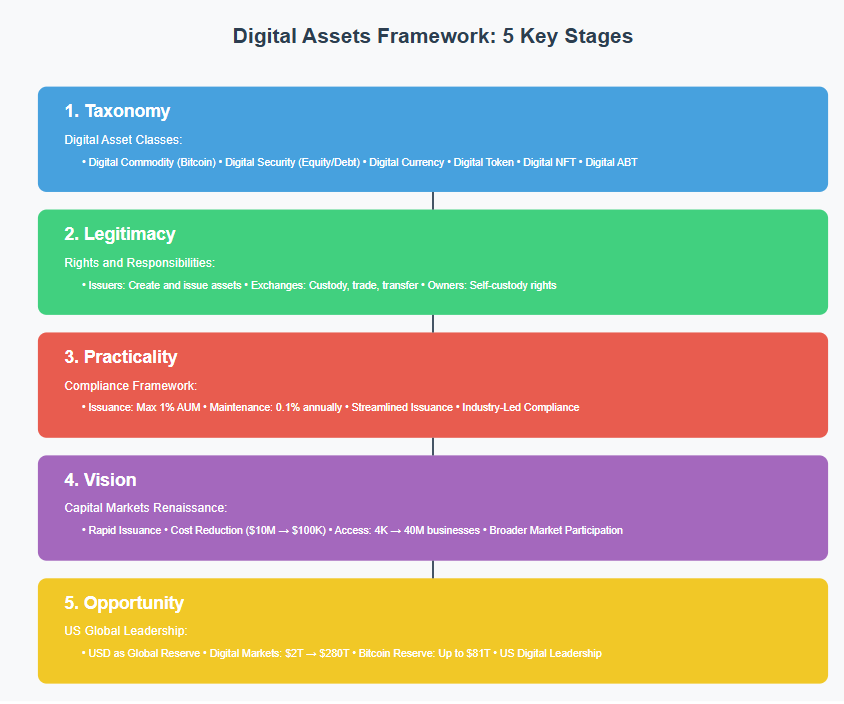

The Bitcoin reserve plan splits digital assets into six types. These include Bitcoin, digital securities, currencies, tokens, NFTs, and asset-backed tokens. “A strategic digital asset policy can strengthen the US dollar, neutralize the national debt, and position America as the global leader in the 21st-century digital economy,” Saylor stated in December.

Streamlined Compliance and Cost Structure

The Bitcoin reserve plan caps costs at 1% for new tokens. Yearly maintenance fees won’t exceed 0.1%. “Digital asset regulation must prioritize efficiency and innovation over friction and bureaucracy,” the proposal states. This could help 40 million businesses join the market, up from 4,000 today.

Also Read: Bitcoin To Drop To $20,000? An Eerie Pattern Signals BTC Doom Drop

Market Expansion and Global Impact

The cryptocurrency market could grow much bigger with this Bitcoin reserve plan. Markets might expand from $2 trillion to $280 trillion. “The US has an opportunity to catalyze a 21st-century capital markets renaissance, unleashing trillions of dollars in value creation,” the proposal notes. The US dollar would become the main digital currency globally.

Implementation and Industry Response

MicroStrategy owns $41 billion worth of Bitcoin – over 439,000 BTC. This backs up Saylor’s push for Bitcoin adoption. The financial system overhaul through this reserve plan sets clear rules for everyone involved.

Mixed Reception and Critical Response

Not everyone supports this answer to regulatory uncertainty. Peter Schiff claims it “would weaken the dollar, exacerbate the national debt, and make America a laughing stock.” Yet many industry experts keep discussing the plan’s potential.

Also Read: Top 3 Cryptocurrencies To Watch For New Year 2025