After four days of heavy outflows, Bitcoin ETF inflows bounced back significantly on December 26, bringing in $475.2 million in fresh capital. The cryptocurrency investment landscape shifted as Bitcoin’s price moved down from $98,000 to $96,000, highlighting ongoing BTC price volatility in the market.

Also Read: $460 Investment in Dogecoin Turns $1 Million

Bitcoin ETFs and the Impact of Market Volatility on Cryptocurrency Investments

Major Fund Movements

Fidelity’s Bitcoin fund dominated the day’s cryptocurrency investment activity with $254.4 million in inflows. ARK’s Bitcoin ETF followed with $186.9 million, while BlackRock’s fund pulled in $56.5 million. The positive flows helped recover from BlackRock’s record $188.7 million outflow on December 24.

Ethereum ETF Growth

The Ethereum ETF market posted strong numbers across three consecutive trading days, reaching $301.6 million in total inflows. Fidelity’s ETH fund brought in $83 million, with BlackRock adding $28.2 million and Grayscale contributing $6 million to the total.

Also Read: Ripple Weekend Price Analysis: Will XRP Surge To A New Price Spot?

Year in Review

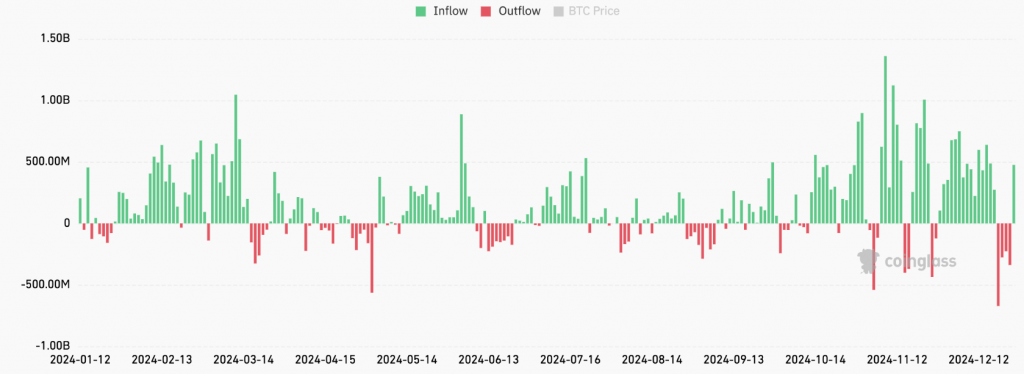

The Bitcoin ETF story in 2024 has been bigger than many expected. Since these funds launched in January, they’ve pulled in a massive $35.9 billion from investors. That money has helped them grow to manage $111.9 billion in total assets – more than many traditional investment funds. The BTC market trends show that big investors keep buying in, even when prices go up and down sharply. Even during weeks when Bitcoin’s price swings made headlines, the ETFs kept attracting new money. This steady flow of cash into Bitcoin ETFs suggests that Wall Street and other big investors now see crypto as a serious investment, not just a trend.

End-of-Year Outlook

The year’s final stretch shows a strong comeback for Bitcoin ETF inflows. With just three trading days left in 2024 – December 27, 30, and 31 – the funds are ending on a high note. The market took a big hit when $1.52 billion left Bitcoin ETFs between December 19 and 24.

The latest numbers paint a brighter picture, with $475.2 million flowing back in on December 26. This quick turnaround suggests big investors aren’t backing away from the market, even after the recent dip. The pattern of money moving in and out of Bitcoin ETFs shows how quickly the market can change direction.

Also Read: VeChain Outperforms Bitcoin, Solana: VET To $0.07 Soon?

Ethereum’s Standing

Ethereum ETFs have grown steadily in the market during 2024. These funds are smaller than Bitcoin ETFs, but they’re growing fast. Investors have put $2.63 billion into Ethereum ETFs this year alone. The funds now hold $12 billion in total – that’s a big win since they’re still pretty new. Regular investment companies now offer these ETF options to their clients. This makes it easier for people to invest in crypto through normal investment accounts. Many investors like having both Bitcoin and Ethereum ETFs. This helps them spread out their crypto investments instead of putting everything in Bitcoin.